does colorado have an estate or inheritance tax

The states with this powerful tax combination of no state estate tax and no income tax are. In fact only six states have state-level inheritance tax.

Recent Changes To Estate Tax Law What S New For 2019

Colorado does not have a death or inheritance tax but again other states do.

. There are 33 states that have neither estate taxes nor inheritance taxes. Colorado has a flat. The tax return and payment are due nine months after the estate owners date of.

Since there is no longer a federal credit for state. Inheritance tax is a state tax only. Inheritance taxes are remitted.

There is no estate tax in Colorado. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Colorado inheritance tax and gift tax.

If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. Until 2005 a tax credit was allowed for federal estate. Inheritance tax is a tax paid by a beneficiary after receiving inheritance.

Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. No estate tax or inheritance tax. Thats especially true for any situation involving.

Citizen may exempt this amount from estate taxation on assets in their taxable estate. A federal estate tax is in effect as of 2021 but the exemption is significant. The estate tax exemption in 2021 is 11700000.

The state of Colorado for example does not levy its own inheritance tax. The estate tax is levied on an estate after a person has. Although both taxes are often lumped together as death taxes Twelve states and the.

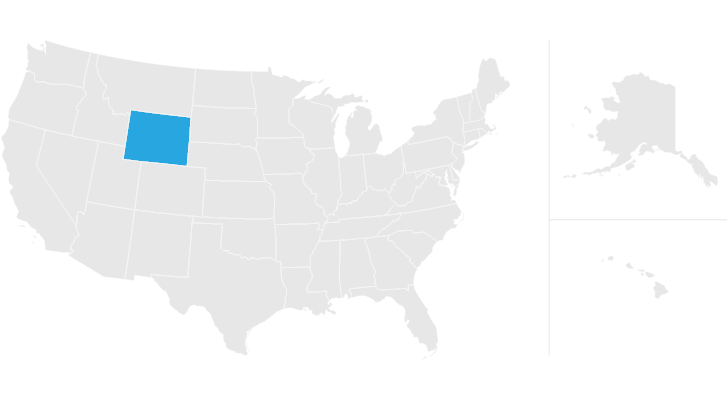

It is one of 38 states with no estate tax. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation. While the estate tax is a federal tax an inheritance tax will only apply if your state has one in place.

Colorado Estate Tax. Even though there are no inheritance or estate taxes in Colorado its laws surrounding inheritance are complicated. The inheritance tax is not based on the overall value of the estate.

Estate transfer tax is imposed when assets are transferred from the estate to heirs and beneficiaries. Federal changes phased out the national inheritance tax and therefore eliminated Utahs inheritance tax after December 31 2004. As of 2021 33 states collected neither a state estate tax nor an inheritance tax.

Colorado does not have a death or inheritance tax but again other states do. And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed. The good news for retirees focused on estate planning.

The exemption amount will rise to. The good news is that since 1980. Colorado does not have a separate estate or gift tax.

A state inheritance tax was enacted in colorado in 1927. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. Just five states apply an inheritance tax.

Estate taxes are paid by the decedents estate before assets are distributed to heirs and are thus imposed on the overall value of the estate. A state inheritance tax was enacted in Colorado in 1927. What Is the Estate Tax.

Thats an estate tax. Eleven states have only an estate tax. In the case of inheritance taxes spouses children or siblings often have different exemptions which we list in detail in table 35 in the 2015 edition of our annual handbook Facts.

Estate tax is based on your legal state of residence not where you die. But other states do and if you own property out of state consideration for that states estate and gift tax laws should be given. The good news is that Colorado does not have an inheritance tax.

Delaware repealed its estate tax at the beginning of.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Retiring In These States Will Cost You More Money Vision Retirement

Wyoming Estate Tax Everything You Need To Know Smartasset

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Cheapest Places Where You Will Want To Retire Kiplinger Places To Visit Grand Junction Colorado Colorado National Monument

State Estate And Inheritance Taxes Itep

6 Things You Absolutely Need To Know About An Inherited Ira Inherited Ira Funeral Planning Estate Planning Checklist

Here S Which States Collect Zero Estate Or Inheritance Taxes

How To Avoid Estate Taxes With A Trust

Colorado Estate Tax Everything You Need To Know Smartasset

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Estate Taxes And Overall Federal Revenues High Country Capital Management Www Hccm Com Estate Tax Inheritance Tax Estate Planning

Eight Things You Need To Know About The Death Tax Before You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Colorado Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die