what is suta tax california

According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. The new-employer tax rate will also remain stable at 340.

Suta Tax Your Questions Answered Bench Accounting

It is often wrongly called Unemployment Insurance or SUI.

. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content. This is due in January 2017 for tax year 2016. Most employers are tax-rated employers and pay UI taxes.

California does have an outstanding loan balance as of January 1 2021 so future. For example if you have eight employees and you pay all of them at least 45000 per year you only need to pay the FUTA tax rate on 56000 total eight employees multiplied by the 7000 FUTA cap. You are required to electronically submit employment.

The SUTA program was developed in each state in 1939 during the Great Depression when the US. The new employer SUI tax rate remains at 34 for 2021. The maximum to withhold for each employee is 160160.

According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. The SDI withholding rate is the same for all employees and is calculated annually. SUTA or the The State Unemployment Tax Act SUTA is a payroll tax paid by all employers at the state level.

The tax rate for new employers is to be 34. In California you are liable for UI taxes once youve paid more than 100 in wages in a calendar year. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state.

Under FUTA f ederal unemployment tax rates are six percent taken on each of your employees first 7000 in wages. The taxable wage limit is 145600 for each employee per calendar year. New employers pay 34 percent 034 for a period of two to three years.

This is unlike many other states which follow the federal rules for UI tax liability under the Federal Unemployment Tax Act FUTA or very similar rules. However some states Alaska New Jersey and Pennsylvania require that you withhold additional money from employee wages for state unemployment taxes SUTA tax. Employers are required to report specific information periodically.

52 rows SUTA the State Unemployment Tax Act is the state unemployment. This means that employers paying wages subject to UI will owe a greater amount of FUTA tax. California has four state payroll taxes.

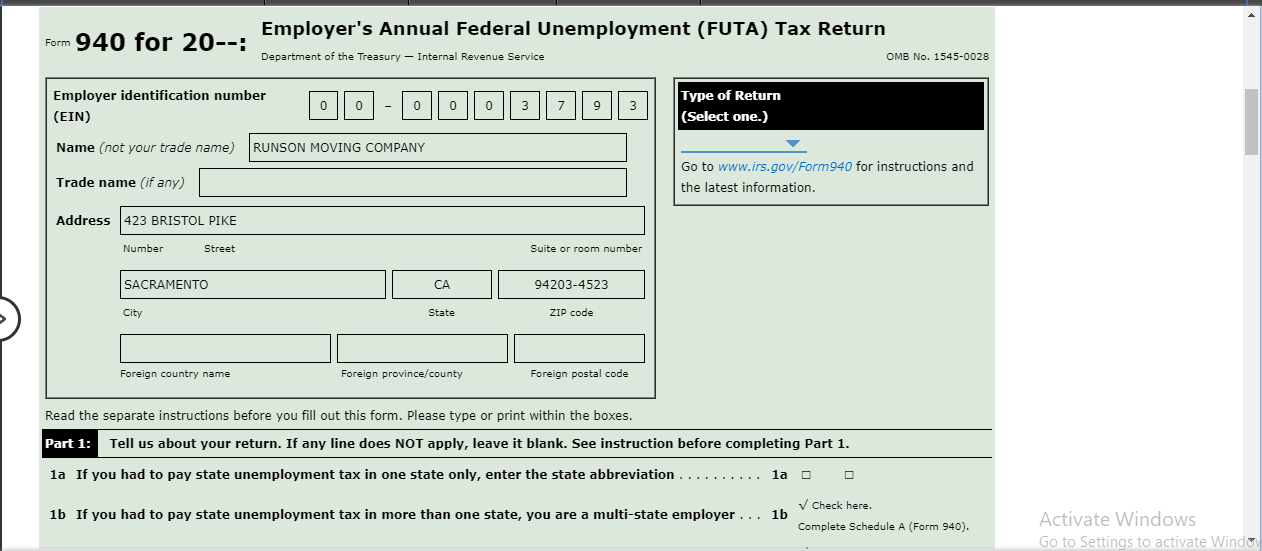

Likewise people ask is Sui and SUTA the same. State Disability Insurance SDI and Personal Income Tax PIT are withheld from employees wages. Employers report this tax by filing an annual Form 940 with the Internal Revenue Service.

1 2021 unemployment tax rates for experienced employers are to be determined with Schedule F and are to range from 15 to 62. Employers in California accrue and pay at the normal 06 rate during the calendar year. What is suta tax rate for california.

Additionally positive-rated employers and new employers are to be assessed an employment training tax of 01 for 2021 unchanged from. The California Employment Development Department has confirmed that unemployment tax rates are unchanged for 2022 on its website. Experienced sky-high unemployment rates.

California Franchise Tax Board Certification date July 1 2021 Contact Accessible Technology Program. The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay. State unemployment tax is a percentage of an employees.

The additional amount of 18 will be added for a total FUTA Tax rate of 24. You cannot protest an SDI rate. States use funds from SUTA tax to pay unemployment benefits to unemployed workers.

Current federal law provides employers with a 54 percent FUTA tax credit and no FUTA tax credit reduction will occur in 2022 for wages paid to their workers in 2021. Rules for UI Tax Liability. AB 664 - With the passage of AB 664 California became one of the first states in the nation to enact legislation as a result of the federal SUTA Dumping Prevention Act.

Click to see full answer. Effective January 1 2022 unemployment tax rates will hold steady as compared to 2021 ranging from 150 to 620. For past tax rates and taxable wage limits refer to Tax Rates Wage Limits and Value of Meals and Lodging DE 3395 PDF or visit Historical Information.

As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers continuing to fall below 06 the 2021 SUI tax rates continue to include a 15 surcharge. 52 rows Generally unemployment taxes are employer-only taxes meaning you do not withhold the tax from employee wages. Detailed information is available in the California Employers Guide DE 44 PDFWe offer several electronic filing and payment options through e-Services for Business and no-fee seminars to help you follow Californias payroll tax laws.

For the majority of states SUTA tax is an employer-only tax. In some cases the employer is required. Unemployment Insurance UI and Employment Training Tax ETT are employer contributions.

It is a tax assessed on employers to fund unemployment benefits. The SDI withholding rate for 2022 is 110 percent. This new law effective January 1 2005 provides for employers who are caught illegally lowering their UI rates to pay at the highest rate provided by law plus an additional 2 percent.

The term SUTA is often used to refer to the employers SUTA rate that is the percent of payroll that is assessed on that particular employer.

How To Update Suta And Ett Rates For California Edd In Quickbooks Desktop Youtube

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

Payroll Taxes Cost Of Hiring An Hourly Worker In California In 2020

The True Cost Of Hiring An Employee In California Hiring True Cost California

How Do I Get My California Employer Account Number

1.jpg)

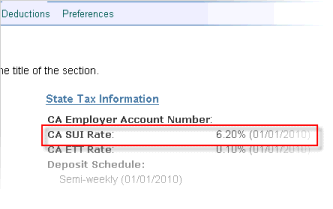

Ca Sdi Deduction Das Drake Accounting How Do I Set Up The Ca Sdi Deduction Summary Of California State Disability Insurance Sdi Setup Confirm That Your Client S State Is Ca Set The Appropriate Ca Rates And Limits For Unemployment And Disability

2.jpg)

Ca Sdi Deduction Das Drake Accounting How Do I Set Up The Ca Sdi Deduction Summary Of California State Disability Insurance Sdi Setup Confirm That Your Client S State Is Ca Set The Appropriate Ca Rates And Limits For Unemployment And Disability

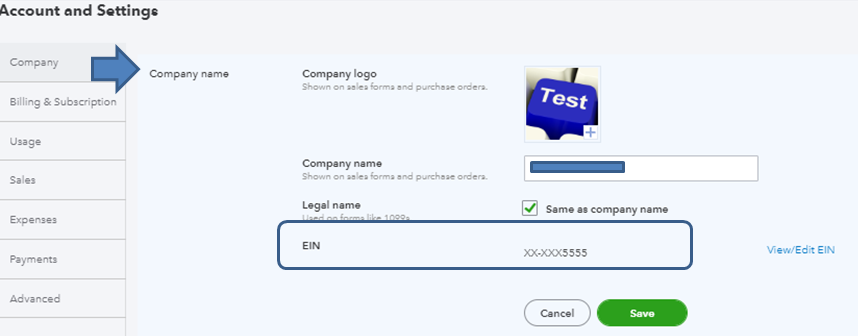

Does Quickbooks Automatically Adjust Employer Payroll Tax Rates At The Beginning Of A New Year Newqbo Com

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

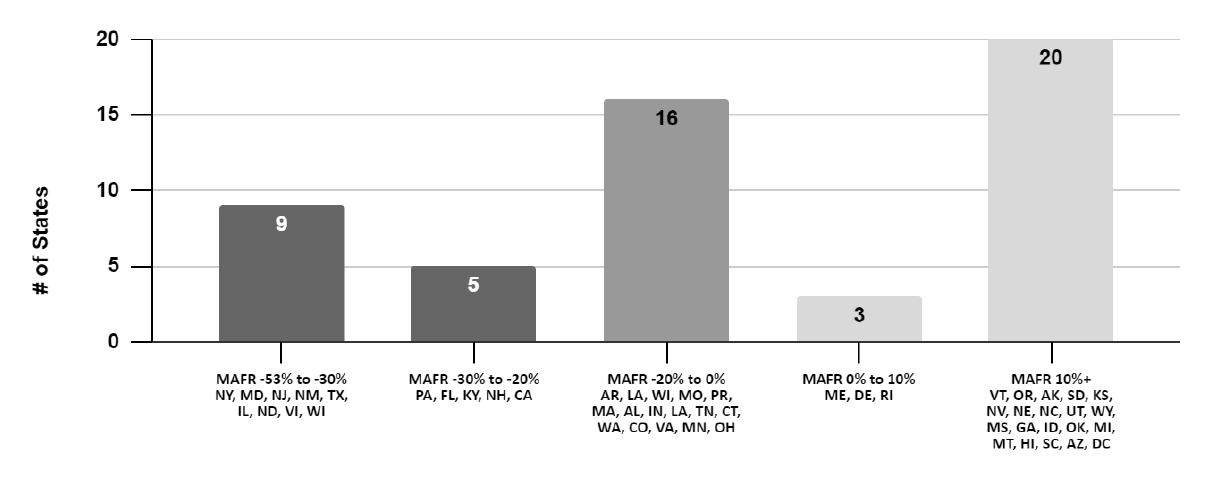

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

2022 Federal State Payroll Tax Rates For Employers

How To Update Suta And Ett Rates For California Edd In Qbo Youtube

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Update Suta And Ett Tax For Quickbooks Online Candus Kampfer

4.jpg)